Fundamental Financial Policy

Financial Policy

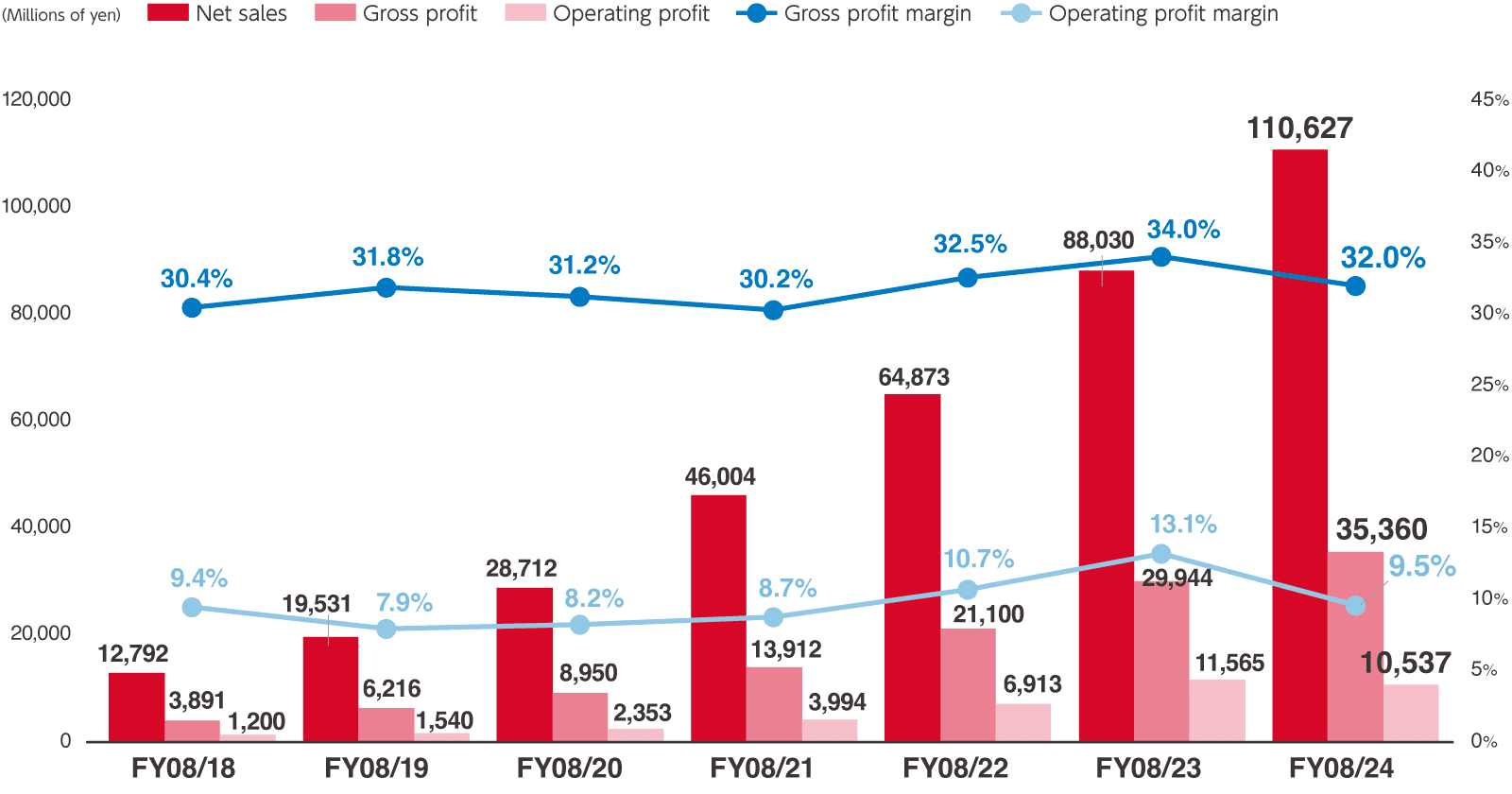

SHIFT focuses on net sales and gross profit (margin) as our main growth KPIs. Operating profit is managed through classifying SG&A cost into two: strategic investment for further growth and operation cost for daily operations. One of the criteria of OP is 10%.

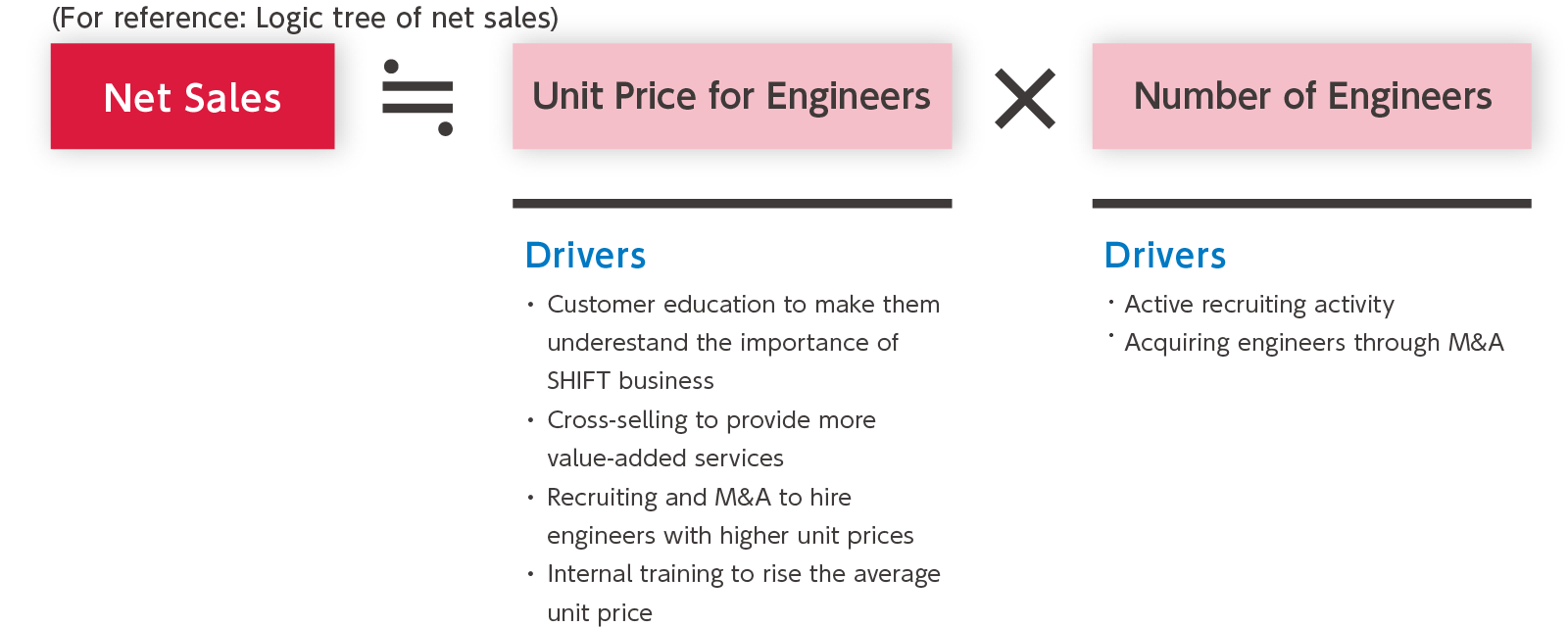

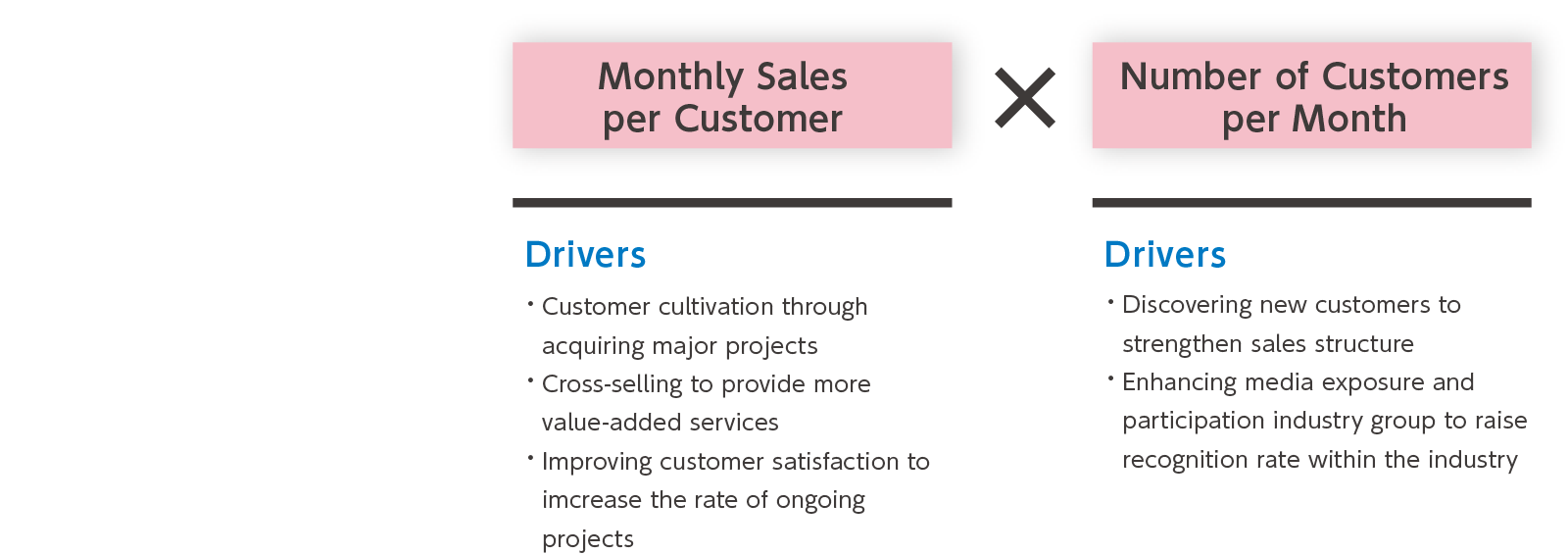

Net sales can be roughly divided into unit price for engineers and number of engineers, or monthly sales per customer and number of customers per month. The gross profit margin is checked by management on a weekly basis and managed on a daily basis so that it does not go significantly below the forecast.

Note: The formula above excludes small customer transactions involving Hinshitsu University, and CAT licenses

Note: The formula above may not apply to some parts of our business fields such as platform business

SHIFT conducts balance sheet management. As a growing company of which demands exceeds supplies, SHIFT manages stability and growth through balance sheet to strengthen corporate foundation which could enable to active investment and support rapid expansion with increaase the number of engineers.

Tax Policy

All executives and employees of SHIFT Group, both in Japan and overseas, not only comply with laws, social norms, and internal regulations, but also make decisions and take actions based on behavioral guidelines relating to ethical judgments. In addition, from the perspective of its responsibility as a public entity of society, we implement taxing practice in good faith with tax laws and regulations since paying taxes to the government and local governments leads to the redistribution of wealth. In practice, CFO acts as a supervisor under a governance system which enables appropriate tax operations. We also manage and supervise the tax affairs of the Group companies so that they can perform their tax affairs appropriately.

1.Optimizing Tax Costs

We try to optimize tax costs through tax relief measures. When we conduct tax planning using tax haven, we comply with local laws and regulations and pay tax imposed appropriately.

2.Relationship with Tax Authorities

We aims at maintaining close contact with tax authorities to comply with laws and regulations.